South Florida's Most Experienced & Trusted Real Estate Agency Since 1924

REAL ESTATE NEWS FROM RYAN REALTY

The Best Most Experienced & Trusted Name in Real Estate in South Florida

NEWS

By John Ryan

•

July 24, 2024

Enhancing your home’s value doesn’t always require a major renovation or a hefty budget. Many do-it-yourself (DIY) projects can make a significant impact on your home’s market value and overall appeal. Whether you're preparing to sell or simply want to increase the value of your investment, these DIY projects can offer high returns with relatively low costs. 1. Upgrade Your Curb Appeal Why It Matters: First impressions count. Improving your home’s exterior can attract potential buyers and boost its perceived value. DIY Projects: Fresh Paint: A new coat of paint on your front door or trim can create a welcoming appearance. Choose a color that complements your home’s exterior. Landscaping: Trim overgrown bushes, plant colorful flowers, and add mulch to garden beds. Simple updates like these can make your yard look well-maintained and inviting. Lighting: Install outdoor lighting to highlight architectural features and improve nighttime curb appeal. Solar-powered lights are an easy and eco-friendly option. 2. Update Kitchen Fixtures Why It Matters: The kitchen is often considered the heart of the home. Modernizing fixtures can enhance both functionality and aesthetics. DIY Projects: Cabinet Hardware: Replace old knobs and handles with contemporary styles. This small change can make a big difference in the look of your kitchen. Backsplash: Install a new backsplash with peel-and-stick tiles for an updated look. It’s a relatively easy and affordable way to add style. Faucets: Swap out outdated faucets for modern, stylish ones. This upgrade can improve both the look and functionality of your kitchen sink. 3. Enhance Bathroom Appeal Why It Matters: Bathrooms are critical selling points. Small updates can create a more modern and appealing space. DIY Projects: Vanity Update: Repaint or refinish your bathroom vanity. Adding new hardware can also give it a fresh look. Mirror and Lighting: Upgrade to a stylish mirror and new light fixtures. Modern lighting can make a small bathroom feel more spacious. Caulking and Grouting: Reapply caulking around sinks and tubs, and clean or re-grout tiles. These small maintenance tasks can greatly improve the appearance of your bathroom. 4. Add Fresh Paint Indoors Why It Matters: A fresh coat of paint can instantly refresh a space and make it feel newer and more appealing. DIY Projects: Neutral Colors: Opt for neutral colors like beige, gray, or off-white. These shades appeal to a broader audience and make rooms feel larger. Accent Walls: Create an accent wall with a bold color or wallpaper to add character and style without overwhelming the space. 5. Improve Flooring Why It Matters: Flooring is a major component of a home’s value. Updating or refreshing your floors can enhance the overall look and feel of your space. DIY Projects: Refinish Hardwood Floors: Sanding and refinishing hardwood floors can remove scratches and restore their original beauty. Install Vinyl or Laminate: For a budget-friendly update, consider installing vinyl or laminate flooring. Modern options can mimic the look of hardwood or tile at a fraction of the cost. 6. Enhance Storage Solutions Why It Matters: Homebuyers often prioritize storage space. Improving storage can make your home more functional and appealing. DIY Projects: Closet Organization: Install shelves, racks, and organizers in closets to maximize storage space and improve organization. Built-In Shelving: Add built-in shelves to living areas or home offices. This addition can create more usable space and add a custom touch. 7. Upgrade Hardware and Fixtures Why It Matters: Modern hardware and fixtures can update the look of your home and improve its functionality. DIY Projects: Door Hardware: Replace old door handles and locks with new, stylish options. This small update can make a noticeable difference. Electrical Fixtures: Update outdated light switches and outlets with new, modern covers. Consider adding dimmer switches for added functionality. 8. Create Outdoor Living Spaces Why It Matters: Outdoor spaces are increasingly important to buyers. Creating an inviting outdoor area can enhance your home’s appeal and value. DIY Projects: Deck or Patio: If you have an existing deck or patio, clean and stain or paint it. Add outdoor furniture and plants to create a comfortable space for relaxation. Fire Pit: Build a simple fire pit using pavers or stones. This addition can become a focal point for gatherings and enhance your outdoor living experience. Conclusion Improving your home’s value doesn’t always require extensive renovations or significant expenditures. Many DIY projects can enhance both the functionality and aesthetics of your home, providing a high return on investment. From boosting curb appeal to modernizing fixtures, these simple and cost-effective updates can make your home more attractive to potential buyers and increase its overall value. Before starting any DIY project, consider your budget, skill level, and the potential impact on your home’s value. With the right approach, you can make meaningful improvements that enhance your living space and increase your property’s appeal.

By John Ryan

•

July 24, 2024

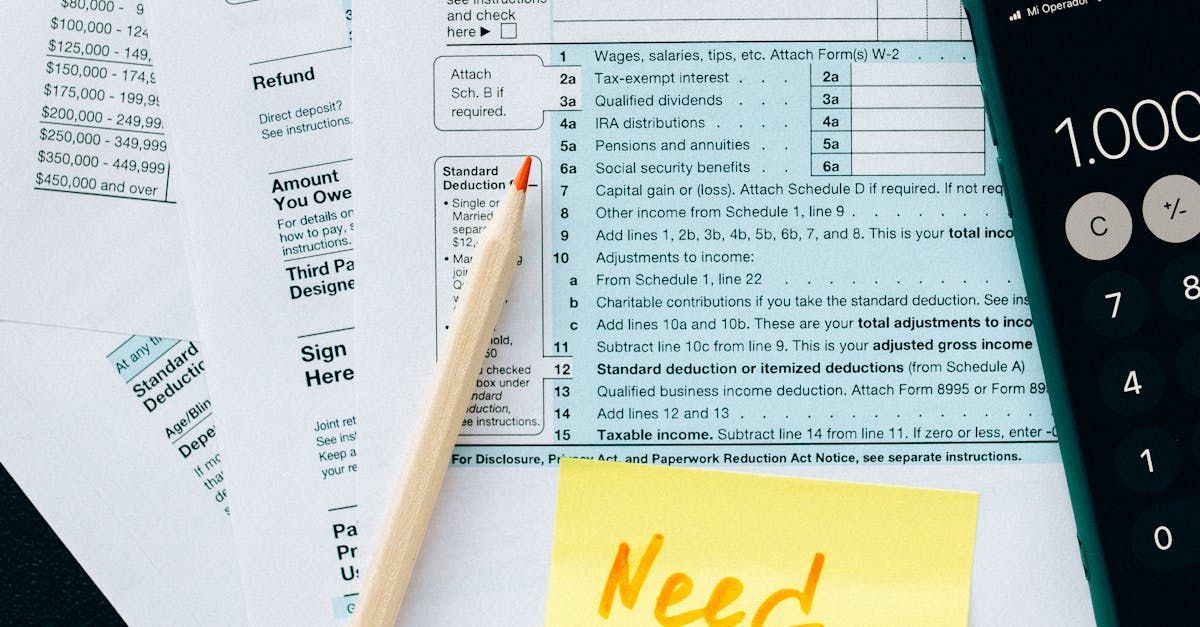

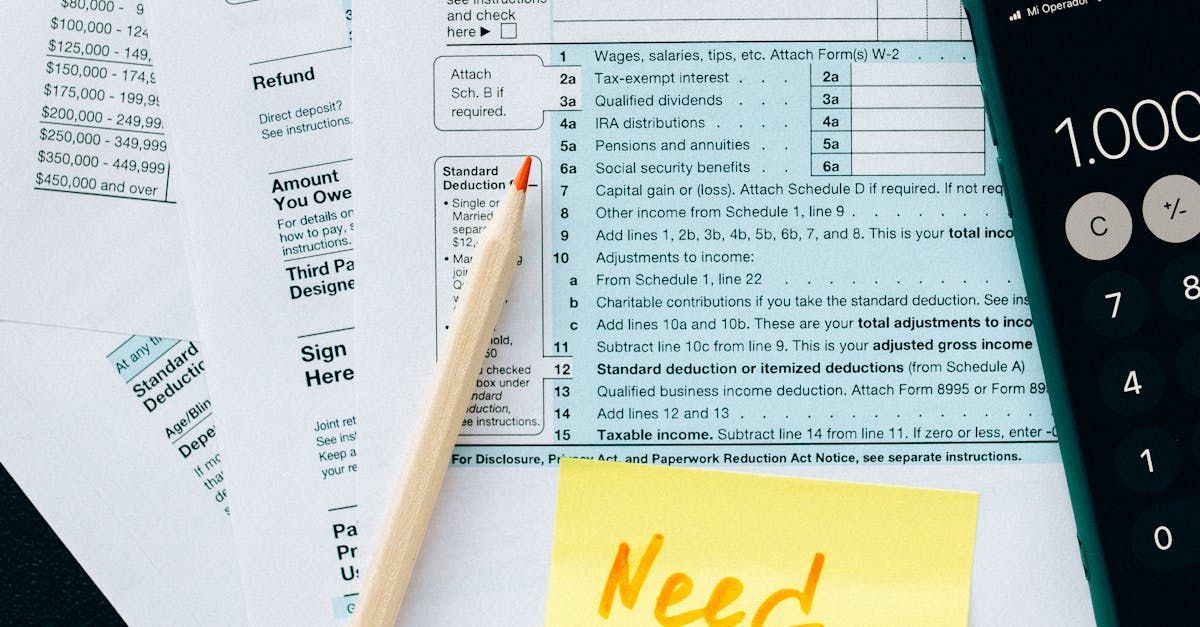

Buying or selling a home is a significant financial decision, and understanding the tax implications is crucial for making informed choices and optimizing your financial outcomes. Whether you’re a first-time homebuyer or a seasoned homeowner, knowing how taxes impact your real estate transactions can help you plan more effectively. Here’s a comprehensive guide to the tax implications of buying and selling a home. 1. Tax Benefits of Buying a Home Purchasing a home comes with several tax advantages that can help reduce your overall tax burden. Here are the primary tax benefits for homeowners: Mortgage Interest Deduction: What It Is: Homeowners can deduct the interest paid on their mortgage from their taxable income. Limitations: For mortgages taken out after December 15, 2017, interest can be deducted on the first $750,000 of mortgage debt ($375,000 if married filing separately). For mortgages before this date, the limit is $1 million. Property Tax Deduction: What It Is: Homeowners can deduct state and local property taxes paid on their home. Limitations: The deduction for state and local taxes, including property taxes, is capped at $10,000 ($5,000 if married filing separately). Mortgage Points Deduction: What It Is: Points paid to lower your mortgage interest rate can be deducted in the year they are paid. Limitations: The mortgage must be secured by your primary residence, and the points must be within the normal range for your area. First-Time Homebuyer Credits: What It Is: Various credits and incentives are available for first-time homebuyers, such as state-level programs offering tax credits. Limitations: Eligibility and benefits vary by state and program. 2. Tax Implications of Selling a Home Selling a home can have significant tax implications, particularly if you’ve owned the property for a long time or it has appreciated in value. Here are the key considerations: Capital Gains Tax: What It Is: Profit from the sale of your home is considered a capital gain and may be subject to taxes. Exclusions: If the home was your primary residence for at least two of the past five years, you can exclude up to $250,000 of gain from your income ($500,000 for married couples filing jointly). Calculating Capital Gains: What It Is: Capital gains are calculated as the difference between the sale price and your adjusted basis (purchase price plus improvements minus depreciation). Example: If you bought a home for $300,000, made $50,000 in improvements, and sold it for $500,000, your capital gain would be $150,000. If you qualify for the exclusion, you wouldn’t owe taxes on the gain. Depreciation Recapture: What It Is: If you claimed depreciation on the property (e.g., for a home office or rental portion), you might owe depreciation recapture tax upon sale. Rate: The recapture is taxed at a maximum rate of 25%. 3. Tax Planning Tips for Buyers and Sellers Effective tax planning can help you maximize your benefits and minimize liabilities when buying or selling a home. Here are some tips: Keep Detailed Records: What to Track: Maintain records of your purchase price, improvements, and selling costs. Why: These records help accurately calculate your basis and potential capital gains. Timing Your Sale: Consider Market Conditions: Selling during a market peak can maximize your gains, but be mindful of potential tax implications. Plan Around Exclusions: Ensure you meet the two-out-of-five-year rule to qualify for the capital gains exclusion. Leverage Tax-Advantaged Accounts: What to Use: Consider using IRA or 401(k) funds for first-time home purchases, where penalties might be waived. Limitations: Be aware of the rules and potential tax consequences. Consult a Tax Professional: Why: Tax laws are complex and constantly changing. A tax professional can provide personalized advice based on your situation. When: Early consultation can help with planning and avoiding surprises at tax time. 4. State and Local Tax Considerations In addition to federal taxes, state and local taxes can also impact your real estate transactions. Consider the following: State Property Taxes: Rates Vary: Property tax rates and assessments vary significantly by state and locality. Exemptions: Some states offer exemptions or reductions for seniors, veterans, and low-income homeowners. Transfer Taxes: What It Is: Some states and localities impose transfer taxes on real estate transactions. Who Pays: The responsibility for paying transfer taxes can fall on the buyer, seller, or both, depending on local laws. Homestead Exemptions: What It Is: Some states offer homestead exemptions that reduce the taxable value of your primary residence. Benefits: These exemptions can lower your property tax bill and provide legal protections against creditors. Conclusion Understanding the tax implications of buying and selling a home is essential for optimizing your financial outcomes and avoiding unexpected liabilities. From leveraging mortgage interest deductions to navigating capital gains exclusions, being informed about the tax aspects of real estate transactions can help you make strategic decisions. Always keep detailed records, plan your transactions carefully, and consult with a tax professional to ensure you’re taking full advantage of available benefits and minimizing your tax burden.

By John Ryan

•

July 24, 2024

As an experienced homeowner, you already have a solid understanding of the basics of buying and selling real estate. However, each transaction presents unique challenges and opportunities. Whether you're looking to upgrade, downsize, or invest in a new property, leveraging your past experiences while adopting new strategies can lead to a successful real estate journey. Here are some advanced tips for buying and selling homes tailored specifically for seasoned homeowners. 1. Understanding Market Conditions Key Considerations: Market Trends: Stay updated on local and national market trends. Understanding whether you're in a buyer's or seller's market can significantly impact your strategy. Economic Indicators: Monitor economic indicators such as interest rates, employment rates, and housing supply, which influence market dynamics. Pro Tip: Use online real estate platforms and tools to track market trends and get a sense of current property values in your area. 2. Maximizing Home Value Before Selling Key Considerations: Pre-Sale Upgrades: Invest in strategic upgrades that offer high ROI, such as kitchen remodels, bathroom renovations, and curb appeal enhancements. Home Staging: Professional staging can make your home more appealing to buyers by showcasing its best features and potential. Pro Tip: Conduct a pre-listing inspection to identify and address any issues that might deter buyers or lower your home's value. 3. Advanced Negotiation Strategies Key Considerations: Multiple Offers: If you're selling, create a competitive bidding environment by setting an attractive listing price. If you're buying, be prepared with a strong, competitive offer. Contingencies: Use contingencies strategically to protect your interests while remaining flexible enough to attract serious buyers or sellers. Pro Tip: Consider hiring an experienced real estate agent with strong negotiation skills to represent your interests effectively. 4. Financial Planning and Considerations Key Considerations: Mortgage Pre-Approval: As an experienced homeowner, ensure you get pre-approved for a mortgage to streamline the buying process and demonstrate your seriousness to sellers. Equity Utilization: Leverage the equity in your current home for a larger down payment or to finance renovations on your new property. Pro Tip: Consult with a financial advisor to understand the tax implications of selling and buying, and to explore financing options that best suit your needs. 5. Timing Your Sale and Purchase Key Considerations: Seasonal Trends: Spring and summer are typically peak times for real estate activity, but selling or buying in the off-season can sometimes yield better deals. Personal Circumstances: Align your real estate moves with your personal life events, such as retirement, job changes, or children’s school schedules. Pro Tip: If possible, try to sell your current home before buying a new one to avoid the stress and financial strain of carrying two mortgages. 6. Utilizing Technology and Digital Tools Key Considerations: Virtual Tours: Use virtual tours and 3D imaging to showcase your home to a wider audience. As a buyer, these tools can help you narrow down your options efficiently. Online Marketplaces: Leverage online real estate platforms for listing your home and searching for new properties. Pro Tip: Use mortgage calculators, property valuation tools, and real estate apps to stay informed and make data-driven decisions. 7. Preparing for a Smooth Transition Key Considerations: Moving Logistics: Plan your move meticulously to ensure a smooth transition between homes. Consider hiring professional movers and scheduling services well in advance. Temporary Housing: If there’s a gap between selling your current home and moving into your new one, arrange for temporary housing to avoid last-minute stress. Pro Tip: Start decluttering and organizing your belongings early to make packing and moving more efficient. Donate, sell, or discard items you no longer need. Conclusion As an experienced homeowner, you have the advantage of past experience and a deeper understanding of the real estate market. By staying informed, leveraging technology, and applying advanced strategies, you can navigate the buying and selling process with confidence and success. Remember, the key to a smooth and profitable real estate transaction is careful planning, strategic decision-making, and utilizing the resources and expertise available to you.

By John Ryan

•

July 24, 2024

Navigating the world of home mortgages can be daunting, especially with the ever-changing landscape of interest rates. As we move through 2024, understanding the factors influencing current mortgage rates, their impact on homebuyers, and the broader economic implications is crucial. This guide will help you make sense of the current mortgage rate environment and offer insights on how to navigate it effectively. 1. Current Mortgage Rate Trends in 2024 As of mid-2024, mortgage rates have shown a mix of stability and slight fluctuation. Here's an overview of the typical rates you might encounter: 30-Year Fixed-Rate Mortgages: These rates are hovering around 6.5% to 7.0%, providing long-term stability for homeowners. 15-Year Fixed-Rate Mortgages: Typically lower than the 30-year rates, these are averaging between 5.5% and 6.0%, appealing to those who can afford higher monthly payments for quicker equity build-up. Adjustable-Rate Mortgages (ARMs): Initial rates for ARMs are often lower, starting around 5.0% to 5.5%, with adjustments based on market conditions after the initial fixed period. 2. Factors Influencing Mortgage Rates Several key factors influence the direction and stability of mortgage rates. Understanding these can help you make more informed decisions: Economic Indicators: Inflation, employment rates, and GDP growth play significant roles. Strong economic growth typically leads to higher rates, while economic slowdowns can result in lower rates. Federal Reserve Policies: The Federal Reserve’s actions, including changes to the federal funds rate and monetary policy decisions, directly impact mortgage rates. Market Demand: High demand for mortgages can drive rates up, while lower demand can cause rates to decrease. Global Events: Political stability, international trade policies, and global economic conditions can also affect mortgage rates indirectly. 3. Impact on Homebuyers Current mortgage rates have several implications for homebuyers in 2024: Affordability: Higher rates mean higher monthly payments, which can affect how much house you can afford. It’s crucial to calculate your budget accurately and consider how rate changes might impact your purchasing power. Loan Types: With current rates, buyers might explore different mortgage options. Fixed-rate mortgages provide stability, while ARMs offer lower initial rates that adjust over time. Refinancing Considerations: Homeowners with existing mortgages might evaluate refinancing options. If current rates are lower than your original rate, refinancing could reduce monthly payments or shorten the loan term. 4. Strategies for Navigating the Mortgage Rate Environment Here are some strategies to help you navigate the current mortgage landscape: Lock-In Rates: If you find a favorable rate, consider locking it in. This can protect you from potential rate increases before closing on your home. Improve Credit Scores: Higher credit scores typically qualify for lower interest rates. Work on improving your credit by paying down debt and addressing any discrepancies on your credit report. Compare Lenders: Shop around and compare offers from multiple lenders. Small differences in rates and terms can lead to significant savings over the life of the loan. Consider Points: Paying for discount points upfront can lower your interest rate. Calculate whether the upfront cost is worth the long-term savings. Stay Informed: Keep an eye on economic news and Federal Reserve announcements. Understanding market trends can help you time your mortgage decisions more effectively. 5. Future Projections and Considerations While it’s challenging to predict exact future movements in mortgage rates, staying informed about potential trends can be beneficial: Economic Recovery: Continued economic recovery and inflation pressures might lead to gradual rate increases. Federal Reserve Actions: Pay attention to the Federal Reserve’s stance on interest rates and monetary policy, as these will significantly influence future mortgage rates. Market Conditions: Real estate market conditions, including housing supply and demand dynamics, will also play a role in future rate trends. Conclusion Understanding the current mortgage rate environment is crucial for making informed homebuying and refinancing decisions. By staying informed about economic factors, comparing different loan options, and implementing effective strategies, you can navigate the mortgage landscape of 2024 with confidence. Remember, the right mortgage can significantly impact your financial well-being, so take the time to research and make the best decision for your situation.

By John Ryan

•

July 24, 2024

Home design trends are constantly evolving, reflecting changes in lifestyle, technology, and aesthetics. As we move through 2024, several exciting trends are shaping the way we live and experience our homes. Whether you're planning a renovation, redecorating, or simply looking for inspiration, these current home design trends offer something for every style and preference. 1. Sustainable and Eco-Friendly Design Sustainability remains a top priority in home design. Eco-friendly materials, energy-efficient appliances, and sustainable building practices are becoming standard. Homeowners are increasingly seeking ways to reduce their environmental footprint while creating beautiful and functional spaces. Key Elements: Recycled and reclaimed materials Energy-efficient lighting and appliances Water-saving fixtures Natural and non-toxic finishes 2. Biophilic Design Biophilic design, which emphasizes a connection to nature, continues to gain popularity. This trend involves incorporating natural elements into the home to create a calming and rejuvenating environment. Key Elements: Indoor plants and green walls Natural light and large windows Natural materials like wood, stone, and bamboo Water features such as indoor fountains 3. Minimalism with Warmth Minimalist design remains popular, but with a warmer and more inviting twist. This trend focuses on clean lines and uncluttered spaces while incorporating warm colors, textures, and personal touches to create a cozy atmosphere. Key Elements: Neutral color palettes with warm tones Textured fabrics and natural fibers Simple, functional furniture Thoughtful decor with personal significance 4. Smart Home Technology The integration of smart technology in home design continues to evolve, making homes more convenient, efficient, and secure. From automated lighting and climate control to advanced security systems, smart home technology is seamlessly blending into modern interiors. Key Elements: Voice-controlled assistants (e.g., Amazon Alexa, Google Home) Smart lighting and thermostat systems Integrated home security systems Smart appliances and home automation hubs 5. Multipurpose Spaces With more people working and studying from home, the need for multipurpose spaces has increased. Flexible design solutions that allow rooms to serve multiple functions are essential for maximizing space and utility. Key Elements: Convertible furniture (e.g., sofa beds, foldable desks) Room dividers and sliding doors Built-in storage solutions Spaces that can transition from work to leisure 6. Bold Colors and Patterns While neutral tones are still prevalent, bold colors and patterns are making a comeback. These vibrant elements add personality and excitement to home interiors, allowing homeowners to express their unique style. Key Elements: Statement walls with bold paint or wallpaper Colorful furnishings and decor Mix-and-match patterns and textures Art and accessories that pop 7. Retro and Vintage Revival Nostalgia is influencing home design, with retro and vintage styles making a significant comeback. Mid-century modern furniture, vintage decor pieces, and retro color schemes are adding character and charm to contemporary homes. Key Elements: Mid-century modern furniture Vintage lighting fixtures and decor Retro color palettes (e.g., mustard yellow, teal, avocado green) Eclectic mix of old and new elements 8. Home Wellness Spaces Creating spaces dedicated to wellness and relaxation is becoming increasingly important. From home gyms and yoga studios to spa-like bathrooms, homeowners are prioritizing their well-being through thoughtful design. Key Elements: Home gyms and workout areas Meditation and yoga spaces Spa-inspired bathrooms with soaking tubs and saunas Calming color schemes and natural materials 9. Artisanal and Handmade Elements There is a growing appreciation for artisanal and handmade elements in home design. Unique, handcrafted pieces add a personal touch and a sense of authenticity to interiors. Key Elements: Handcrafted furniture and decor Custom-made textiles and ceramics Locally sourced art and accessories Emphasis on craftsmanship and quality Conclusion The home design trends of 2024 reflect a blend of sustainability, technology, and personal expression. Whether you're drawn to the simplicity of minimalism, the vibrancy of bold colors, or the comfort of biophilic design, there's a trend that can help transform your living space into a haven that suits your lifestyle and tastes. Embrace these trends to create a home that is not only beautiful but also functional, sustainable, and uniquely yours.

By John Ryan

•

July 24, 2024

The real estate industry has undergone a significant transformation with the advent of technology. From virtual tours to AI-driven analytics, technology has revolutionized how buyers and sellers navigate the property market. Here’s a look at how technology is empowering real estate buyers and sellers, making the process more efficient, transparent, and accessible. 1. Virtual Tours and 3D Imaging One of the most impactful advancements in real estate technology is the ability to offer virtual tours and 3D imaging. This innovation allows buyers to explore properties from the comfort of their homes. High-resolution images, 360-degree views, and interactive floor plans provide a comprehensive understanding of a property’s layout and features. This technology saves time for both buyers and sellers by reducing the number of in-person viewings needed. For Sellers: Enhances property listings with immersive experiences. Attracts more potential buyers by providing detailed virtual access. Reduces disruption by limiting unnecessary viewings. For Buyers: Enables remote property viewing, making it easier to shortlist homes. Provides a realistic sense of space and layout. Facilitates decision-making without the need for multiple in-person visits. 2. AI and Big Data Analytics Artificial Intelligence (AI) and big data analytics have become integral to the real estate industry. These technologies analyze vast amounts of data to provide insights into market trends, property values, and buyer preferences. For Sellers: Helps in setting competitive prices based on market data. Identifies the best time to sell by analyzing market trends. Targets marketing efforts to reach the most likely buyers. For Buyers: Provides personalized property recommendations based on search history and preferences. Analyzes market trends to identify the best time to buy. Offers insights into neighborhood demographics, crime rates, and school quality. 3. Mobile Apps and Online Platforms Mobile apps and online platforms have made it easier than ever to buy and sell homes. These tools offer a range of services, from property searches and listings to mortgage calculators and real-time market updates. For Sellers: Allows for easy listing management and tracking. Connects sellers with potential buyers through integrated messaging systems. Provides tools for creating and managing virtual tours and open houses. For Buyers: Facilitates property searches with filters for location, price, and features. Offers tools for calculating mortgage payments and comparing loan options. Provides access to market trends and property history. 4. Blockchain and Smart Contracts Blockchain technology and smart contracts are bringing greater transparency and security to real estate transactions. By creating tamper-proof records and automating contract execution, these technologies reduce fraud and streamline the buying and selling process. For Sellers: Ensures secure and transparent transactions. Automates contract execution, reducing paperwork and processing time. Provides a permanent and immutable record of the transaction. For Buyers: Increases transparency in property history and ownership records. Reduces the risk of fraud and disputes. Simplifies the transaction process with automated smart contracts. 5. Augmented Reality (AR) and Virtual Reality (VR) AR and VR technologies are enhancing the real estate experience by providing immersive property tours and virtual staging. These tools help buyers visualize properties in different configurations and styles. For Sellers: Offers virtual staging to showcase different interior designs. Enhances property listings with immersive VR tours. Attracts tech-savvy buyers with cutting-edge viewing experiences. For Buyers: Allows for virtual walkthroughs of properties. Helps visualize renovations or customizations. Provides a realistic sense of space and design options. 6. Digital Transaction Management Digital transaction management platforms streamline the paperwork and processes involved in real estate transactions. These platforms enable electronic signatures, document storage, and transaction tracking. For Sellers: Reduces the need for physical paperwork. Speeds up the transaction process with electronic signatures. Provides a secure platform for managing transaction documents. For Buyers: Simplifies the process of submitting and managing offers. Provides a centralized location for all transaction documents. Facilitates quicker and more efficient closings. Conclusion Technology has transformed the real estate industry, offering numerous tools and platforms that make buying and selling homes more efficient, transparent, and accessible. From virtual tours and AI-driven analytics to blockchain and digital transaction management, these advancements empower buyers and sellers to make informed decisions and streamline the real estate process. Embracing these technologies can significantly enhance your real estate experience, whether you’re looking to buy your dream home or sell your property at the best price.

By John Ryan

•

July 24, 2024

Navigating the real estate market can be a complex and challenging process. Whether you’re buying your first home or selling your current property, enlisting the help of a professional realtor can make a significant difference. Realtors offer expertise, experience, and a range of services that can streamline your real estate journey and help you achieve the best possible outcome. Here are several compelling reasons why you should consider using a realtor when buying or selling a home. 1. Expert Knowledge and Experience Realtors possess in-depth knowledge of the real estate market, including current trends, property values, and neighborhood insights. Their experience enables them to provide accurate market analyses and advise on realistic pricing, ensuring you make informed decisions. For buyers, realtors can identify properties that meet your criteria and budget. For sellers, they can help price your home competitively to attract potential buyers. 2. Access to Comprehensive Listings Realtors have access to the Multiple Listing Service (MLS), a comprehensive database of available properties that is not fully accessible to the general public. This access allows them to find a wider range of potential homes for buyers and ensure sellers’ properties are widely advertised to qualified buyers. This exposure can significantly enhance your chances of finding the right home or buyer. 3. Skilled Negotiation Negotiation is a crucial aspect of the real estate process. Realtors are skilled negotiators who can effectively advocate for your interests. They handle the negotiation process, ensuring you get the best possible deal. For buyers, this means securing a fair price and favorable terms. For sellers, it involves negotiating offers to maximize your profit while addressing any contingencies. 4. Time and Stress Management Buying or selling a home can be time-consuming and stressful. Realtors handle the legwork, from scheduling showings and open houses to managing paperwork and coordinating with other professionals like inspectors, appraisers, and attorneys. This allows you to focus on your daily responsibilities while they manage the complexities of the transaction. 5. Comprehensive Market Analysis Realtors conduct thorough market analyses to help you understand current market conditions and trends. For sellers, this means setting a competitive price based on recent comparable sales and market demand. For buyers, it involves identifying properties that are priced fairly and have good investment potential. 6. Professional Networking Realtors have an extensive network of professionals, including mortgage brokers, home inspectors, contractors, and attorneys. This network can be invaluable in ensuring a smooth transaction. They can recommend trusted service providers and coordinate their services, making the process more efficient and less stressful. 7. Legal Expertise and Protection Real estate transactions involve complex legal documents and requirements. Realtors are well-versed in the legal aspects of buying and selling homes, ensuring that all paperwork is completed accurately and on time. They protect your interests by ensuring that the contract terms are fair and that you are in compliance with all legal obligations. 8. Marketing and Exposure For sellers, effective marketing is crucial to attracting potential buyers. Realtors use a variety of marketing strategies, including professional photography, virtual tours, online listings, social media promotion, and open houses. This multi-faceted approach ensures that your property receives maximum exposure, leading to quicker and more profitable sales. 9. Objective Advice and Support Realtors provide objective advice and support throughout the buying or selling process. They help you stay focused on your goals, providing valuable insights and keeping emotions in check during negotiations. Their objective perspective is essential in making informed decisions and avoiding common pitfalls. 10. After-Sale Assistance A realtor’s support doesn’t end at closing. They can assist with post-sale matters such as recommending moving companies, helping with transitional logistics, and providing information on local services and amenities. This ongoing support ensures a smooth transition into your new home or next chapter. Conclusion Hiring a realtor when buying or selling a home offers numerous benefits that can save you time, money, and stress. Their expertise, market knowledge, negotiation skills, and professional network provide invaluable support throughout the real estate process. Whether you’re a first-time homebuyer, a seasoned investor, or looking to sell your property, partnering with a professional realtor can help you achieve your real estate goals with confidence and ease.

By John Ryan

•

July 24, 2024

The Importance of Proper Home Maintenance: Safeguarding Your Investment and Peace of Mind Owning a home is one of the most significant investments you'll make in your lifetime. Beyond the initial purchase, maintaining your home is crucial to preserving its value, ensuring its safety, and enhancing your quality of life. Proper home maintenance is not just about keeping things looking good; it's about protecting your investment and avoiding costly repairs down the line. Here’s why home maintenance should be a top priority for every homeowner. 1. Preserves Home Value Regular maintenance helps retain and even increase the value of your home. Small issues left unchecked can escalate into significant problems, which can be costly to fix and may reduce your home’s market value. Keeping up with routine tasks, such as painting, landscaping, and cleaning, ensures your home remains attractive and functional. 2. Prevents Major Repairs Addressing minor repairs promptly can prevent them from becoming major, expensive issues. For example, fixing a small roof leak early can prevent extensive water damage and mold growth. Regular inspections and maintenance of your HVAC system, plumbing, and electrical systems can identify potential problems before they turn into emergencies. 3. Enhances Safety A well-maintained home is a safe home. Regular checks and repairs can prevent accidents and health hazards. For instance, maintaining smoke detectors, ensuring proper electrical wiring, and fixing structural issues like loose railings or uneven flooring can prevent injuries and enhance the safety of your living environment. 4. Saves Money in the Long Run While home maintenance involves an upfront investment of time and money, it ultimately saves you money by avoiding costly repairs and replacements. Regular servicing of appliances and systems can extend their lifespan, reducing the need for premature replacements. Energy-efficient upgrades and proper insulation can also lower utility bills. 5. Improves Comfort and Quality of Life A well-maintained home is more comfortable and enjoyable to live in. Proper insulation and HVAC maintenance ensure consistent temperatures, while pest control and regular cleaning improve indoor air quality. Keeping your home in good condition enhances your day-to-day living experience and makes your home a more pleasant place to be. 6. Increases Energy Efficiency Regular maintenance contributes to energy efficiency, which is both environmentally friendly and cost-effective. Simple tasks like sealing gaps and cracks, maintaining your HVAC system, and ensuring your home is properly insulated can significantly reduce energy consumption and lower your utility bills. 7. Boosts Curb Appeal The exterior of your home is the first thing people see, and it reflects the care you put into your property. Regular maintenance tasks such as painting, cleaning gutters, and landscaping can boost your home's curb appeal. This is especially important if you plan to sell your home, as a well-maintained exterior can attract potential buyers and increase your property’s market value. Essential Home Maintenance Tasks 1. Seasonal Inspections: Spring: Inspect the roof, gutters, and downspouts; check for foundation cracks; service the HVAC system. Summer: Maintain landscaping; inspect windows and doors for leaks; clean and repair deck or patio. Fall: Clean gutters; check and service heating system; inspect attic insulation. Winter: Check for ice dams; test smoke and carbon monoxide detectors; ensure pipes are insulated. 2. Regular Cleaning: Clean and inspect appliances. Maintain clean and dry basements and crawl spaces. Clean and service chimneys and fireplaces. 3. Safety Checks: Test smoke and carbon monoxide detectors regularly. Inspect and maintain fire extinguishers. Ensure all locks and security systems are functioning properly. 4. System Maintenance: Regularly service HVAC systems. Flush water heaters to remove sediment. Inspect plumbing for leaks and fix promptly. Conclusion Proper home maintenance is an ongoing process that requires diligence and effort, but the benefits far outweigh the costs. By keeping up with regular maintenance tasks, you can protect your investment, enhance your home’s safety and comfort, and save money in the long run. Make a maintenance schedule, stay organized, and don’t hesitate to call professionals for tasks that require specialized skills. Your home is a valuable asset, and taking care of it will ensure it remains a source of pride and comfort for years to come.

FIND YOUR DREAM PROPERTY

Can’t find what you want in our listings? Let us know what you’re looking for and we’ll help you find the house of your dreams.

CONTACT US

By John Ryan

•

July 24, 2024

Enhancing your home’s value doesn’t always require a major renovation or a hefty budget. Many do-it-yourself (DIY) projects can make a significant impact on your home’s market value and overall appeal. Whether you're preparing to sell or simply want to increase the value of your investment, these DIY projects can offer high returns with relatively low costs. 1. Upgrade Your Curb Appeal Why It Matters: First impressions count. Improving your home’s exterior can attract potential buyers and boost its perceived value. DIY Projects: Fresh Paint: A new coat of paint on your front door or trim can create a welcoming appearance. Choose a color that complements your home’s exterior. Landscaping: Trim overgrown bushes, plant colorful flowers, and add mulch to garden beds. Simple updates like these can make your yard look well-maintained and inviting. Lighting: Install outdoor lighting to highlight architectural features and improve nighttime curb appeal. Solar-powered lights are an easy and eco-friendly option. 2. Update Kitchen Fixtures Why It Matters: The kitchen is often considered the heart of the home. Modernizing fixtures can enhance both functionality and aesthetics. DIY Projects: Cabinet Hardware: Replace old knobs and handles with contemporary styles. This small change can make a big difference in the look of your kitchen. Backsplash: Install a new backsplash with peel-and-stick tiles for an updated look. It’s a relatively easy and affordable way to add style. Faucets: Swap out outdated faucets for modern, stylish ones. This upgrade can improve both the look and functionality of your kitchen sink. 3. Enhance Bathroom Appeal Why It Matters: Bathrooms are critical selling points. Small updates can create a more modern and appealing space. DIY Projects: Vanity Update: Repaint or refinish your bathroom vanity. Adding new hardware can also give it a fresh look. Mirror and Lighting: Upgrade to a stylish mirror and new light fixtures. Modern lighting can make a small bathroom feel more spacious. Caulking and Grouting: Reapply caulking around sinks and tubs, and clean or re-grout tiles. These small maintenance tasks can greatly improve the appearance of your bathroom. 4. Add Fresh Paint Indoors Why It Matters: A fresh coat of paint can instantly refresh a space and make it feel newer and more appealing. DIY Projects: Neutral Colors: Opt for neutral colors like beige, gray, or off-white. These shades appeal to a broader audience and make rooms feel larger. Accent Walls: Create an accent wall with a bold color or wallpaper to add character and style without overwhelming the space. 5. Improve Flooring Why It Matters: Flooring is a major component of a home’s value. Updating or refreshing your floors can enhance the overall look and feel of your space. DIY Projects: Refinish Hardwood Floors: Sanding and refinishing hardwood floors can remove scratches and restore their original beauty. Install Vinyl or Laminate: For a budget-friendly update, consider installing vinyl or laminate flooring. Modern options can mimic the look of hardwood or tile at a fraction of the cost. 6. Enhance Storage Solutions Why It Matters: Homebuyers often prioritize storage space. Improving storage can make your home more functional and appealing. DIY Projects: Closet Organization: Install shelves, racks, and organizers in closets to maximize storage space and improve organization. Built-In Shelving: Add built-in shelves to living areas or home offices. This addition can create more usable space and add a custom touch. 7. Upgrade Hardware and Fixtures Why It Matters: Modern hardware and fixtures can update the look of your home and improve its functionality. DIY Projects: Door Hardware: Replace old door handles and locks with new, stylish options. This small update can make a noticeable difference. Electrical Fixtures: Update outdated light switches and outlets with new, modern covers. Consider adding dimmer switches for added functionality. 8. Create Outdoor Living Spaces Why It Matters: Outdoor spaces are increasingly important to buyers. Creating an inviting outdoor area can enhance your home’s appeal and value. DIY Projects: Deck or Patio: If you have an existing deck or patio, clean and stain or paint it. Add outdoor furniture and plants to create a comfortable space for relaxation. Fire Pit: Build a simple fire pit using pavers or stones. This addition can become a focal point for gatherings and enhance your outdoor living experience. Conclusion Improving your home’s value doesn’t always require extensive renovations or significant expenditures. Many DIY projects can enhance both the functionality and aesthetics of your home, providing a high return on investment. From boosting curb appeal to modernizing fixtures, these simple and cost-effective updates can make your home more attractive to potential buyers and increase its overall value. Before starting any DIY project, consider your budget, skill level, and the potential impact on your home’s value. With the right approach, you can make meaningful improvements that enhance your living space and increase your property’s appeal.

By John Ryan

•

July 24, 2024

Buying or selling a home is a significant financial decision, and understanding the tax implications is crucial for making informed choices and optimizing your financial outcomes. Whether you’re a first-time homebuyer or a seasoned homeowner, knowing how taxes impact your real estate transactions can help you plan more effectively. Here’s a comprehensive guide to the tax implications of buying and selling a home. 1. Tax Benefits of Buying a Home Purchasing a home comes with several tax advantages that can help reduce your overall tax burden. Here are the primary tax benefits for homeowners: Mortgage Interest Deduction: What It Is: Homeowners can deduct the interest paid on their mortgage from their taxable income. Limitations: For mortgages taken out after December 15, 2017, interest can be deducted on the first $750,000 of mortgage debt ($375,000 if married filing separately). For mortgages before this date, the limit is $1 million. Property Tax Deduction: What It Is: Homeowners can deduct state and local property taxes paid on their home. Limitations: The deduction for state and local taxes, including property taxes, is capped at $10,000 ($5,000 if married filing separately). Mortgage Points Deduction: What It Is: Points paid to lower your mortgage interest rate can be deducted in the year they are paid. Limitations: The mortgage must be secured by your primary residence, and the points must be within the normal range for your area. First-Time Homebuyer Credits: What It Is: Various credits and incentives are available for first-time homebuyers, such as state-level programs offering tax credits. Limitations: Eligibility and benefits vary by state and program. 2. Tax Implications of Selling a Home Selling a home can have significant tax implications, particularly if you’ve owned the property for a long time or it has appreciated in value. Here are the key considerations: Capital Gains Tax: What It Is: Profit from the sale of your home is considered a capital gain and may be subject to taxes. Exclusions: If the home was your primary residence for at least two of the past five years, you can exclude up to $250,000 of gain from your income ($500,000 for married couples filing jointly). Calculating Capital Gains: What It Is: Capital gains are calculated as the difference between the sale price and your adjusted basis (purchase price plus improvements minus depreciation). Example: If you bought a home for $300,000, made $50,000 in improvements, and sold it for $500,000, your capital gain would be $150,000. If you qualify for the exclusion, you wouldn’t owe taxes on the gain. Depreciation Recapture: What It Is: If you claimed depreciation on the property (e.g., for a home office or rental portion), you might owe depreciation recapture tax upon sale. Rate: The recapture is taxed at a maximum rate of 25%. 3. Tax Planning Tips for Buyers and Sellers Effective tax planning can help you maximize your benefits and minimize liabilities when buying or selling a home. Here are some tips: Keep Detailed Records: What to Track: Maintain records of your purchase price, improvements, and selling costs. Why: These records help accurately calculate your basis and potential capital gains. Timing Your Sale: Consider Market Conditions: Selling during a market peak can maximize your gains, but be mindful of potential tax implications. Plan Around Exclusions: Ensure you meet the two-out-of-five-year rule to qualify for the capital gains exclusion. Leverage Tax-Advantaged Accounts: What to Use: Consider using IRA or 401(k) funds for first-time home purchases, where penalties might be waived. Limitations: Be aware of the rules and potential tax consequences. Consult a Tax Professional: Why: Tax laws are complex and constantly changing. A tax professional can provide personalized advice based on your situation. When: Early consultation can help with planning and avoiding surprises at tax time. 4. State and Local Tax Considerations In addition to federal taxes, state and local taxes can also impact your real estate transactions. Consider the following: State Property Taxes: Rates Vary: Property tax rates and assessments vary significantly by state and locality. Exemptions: Some states offer exemptions or reductions for seniors, veterans, and low-income homeowners. Transfer Taxes: What It Is: Some states and localities impose transfer taxes on real estate transactions. Who Pays: The responsibility for paying transfer taxes can fall on the buyer, seller, or both, depending on local laws. Homestead Exemptions: What It Is: Some states offer homestead exemptions that reduce the taxable value of your primary residence. Benefits: These exemptions can lower your property tax bill and provide legal protections against creditors. Conclusion Understanding the tax implications of buying and selling a home is essential for optimizing your financial outcomes and avoiding unexpected liabilities. From leveraging mortgage interest deductions to navigating capital gains exclusions, being informed about the tax aspects of real estate transactions can help you make strategic decisions. Always keep detailed records, plan your transactions carefully, and consult with a tax professional to ensure you’re taking full advantage of available benefits and minimizing your tax burden.

By John Ryan

•

July 24, 2024

As an experienced homeowner, you already have a solid understanding of the basics of buying and selling real estate. However, each transaction presents unique challenges and opportunities. Whether you're looking to upgrade, downsize, or invest in a new property, leveraging your past experiences while adopting new strategies can lead to a successful real estate journey. Here are some advanced tips for buying and selling homes tailored specifically for seasoned homeowners. 1. Understanding Market Conditions Key Considerations: Market Trends: Stay updated on local and national market trends. Understanding whether you're in a buyer's or seller's market can significantly impact your strategy. Economic Indicators: Monitor economic indicators such as interest rates, employment rates, and housing supply, which influence market dynamics. Pro Tip: Use online real estate platforms and tools to track market trends and get a sense of current property values in your area. 2. Maximizing Home Value Before Selling Key Considerations: Pre-Sale Upgrades: Invest in strategic upgrades that offer high ROI, such as kitchen remodels, bathroom renovations, and curb appeal enhancements. Home Staging: Professional staging can make your home more appealing to buyers by showcasing its best features and potential. Pro Tip: Conduct a pre-listing inspection to identify and address any issues that might deter buyers or lower your home's value. 3. Advanced Negotiation Strategies Key Considerations: Multiple Offers: If you're selling, create a competitive bidding environment by setting an attractive listing price. If you're buying, be prepared with a strong, competitive offer. Contingencies: Use contingencies strategically to protect your interests while remaining flexible enough to attract serious buyers or sellers. Pro Tip: Consider hiring an experienced real estate agent with strong negotiation skills to represent your interests effectively. 4. Financial Planning and Considerations Key Considerations: Mortgage Pre-Approval: As an experienced homeowner, ensure you get pre-approved for a mortgage to streamline the buying process and demonstrate your seriousness to sellers. Equity Utilization: Leverage the equity in your current home for a larger down payment or to finance renovations on your new property. Pro Tip: Consult with a financial advisor to understand the tax implications of selling and buying, and to explore financing options that best suit your needs. 5. Timing Your Sale and Purchase Key Considerations: Seasonal Trends: Spring and summer are typically peak times for real estate activity, but selling or buying in the off-season can sometimes yield better deals. Personal Circumstances: Align your real estate moves with your personal life events, such as retirement, job changes, or children’s school schedules. Pro Tip: If possible, try to sell your current home before buying a new one to avoid the stress and financial strain of carrying two mortgages. 6. Utilizing Technology and Digital Tools Key Considerations: Virtual Tours: Use virtual tours and 3D imaging to showcase your home to a wider audience. As a buyer, these tools can help you narrow down your options efficiently. Online Marketplaces: Leverage online real estate platforms for listing your home and searching for new properties. Pro Tip: Use mortgage calculators, property valuation tools, and real estate apps to stay informed and make data-driven decisions. 7. Preparing for a Smooth Transition Key Considerations: Moving Logistics: Plan your move meticulously to ensure a smooth transition between homes. Consider hiring professional movers and scheduling services well in advance. Temporary Housing: If there’s a gap between selling your current home and moving into your new one, arrange for temporary housing to avoid last-minute stress. Pro Tip: Start decluttering and organizing your belongings early to make packing and moving more efficient. Donate, sell, or discard items you no longer need. Conclusion As an experienced homeowner, you have the advantage of past experience and a deeper understanding of the real estate market. By staying informed, leveraging technology, and applying advanced strategies, you can navigate the buying and selling process with confidence and success. Remember, the key to a smooth and profitable real estate transaction is careful planning, strategic decision-making, and utilizing the resources and expertise available to you.

By John Ryan

•

July 24, 2024

Navigating the world of home mortgages can be daunting, especially with the ever-changing landscape of interest rates. As we move through 2024, understanding the factors influencing current mortgage rates, their impact on homebuyers, and the broader economic implications is crucial. This guide will help you make sense of the current mortgage rate environment and offer insights on how to navigate it effectively. 1. Current Mortgage Rate Trends in 2024 As of mid-2024, mortgage rates have shown a mix of stability and slight fluctuation. Here's an overview of the typical rates you might encounter: 30-Year Fixed-Rate Mortgages: These rates are hovering around 6.5% to 7.0%, providing long-term stability for homeowners. 15-Year Fixed-Rate Mortgages: Typically lower than the 30-year rates, these are averaging between 5.5% and 6.0%, appealing to those who can afford higher monthly payments for quicker equity build-up. Adjustable-Rate Mortgages (ARMs): Initial rates for ARMs are often lower, starting around 5.0% to 5.5%, with adjustments based on market conditions after the initial fixed period. 2. Factors Influencing Mortgage Rates Several key factors influence the direction and stability of mortgage rates. Understanding these can help you make more informed decisions: Economic Indicators: Inflation, employment rates, and GDP growth play significant roles. Strong economic growth typically leads to higher rates, while economic slowdowns can result in lower rates. Federal Reserve Policies: The Federal Reserve’s actions, including changes to the federal funds rate and monetary policy decisions, directly impact mortgage rates. Market Demand: High demand for mortgages can drive rates up, while lower demand can cause rates to decrease. Global Events: Political stability, international trade policies, and global economic conditions can also affect mortgage rates indirectly. 3. Impact on Homebuyers Current mortgage rates have several implications for homebuyers in 2024: Affordability: Higher rates mean higher monthly payments, which can affect how much house you can afford. It’s crucial to calculate your budget accurately and consider how rate changes might impact your purchasing power. Loan Types: With current rates, buyers might explore different mortgage options. Fixed-rate mortgages provide stability, while ARMs offer lower initial rates that adjust over time. Refinancing Considerations: Homeowners with existing mortgages might evaluate refinancing options. If current rates are lower than your original rate, refinancing could reduce monthly payments or shorten the loan term. 4. Strategies for Navigating the Mortgage Rate Environment Here are some strategies to help you navigate the current mortgage landscape: Lock-In Rates: If you find a favorable rate, consider locking it in. This can protect you from potential rate increases before closing on your home. Improve Credit Scores: Higher credit scores typically qualify for lower interest rates. Work on improving your credit by paying down debt and addressing any discrepancies on your credit report. Compare Lenders: Shop around and compare offers from multiple lenders. Small differences in rates and terms can lead to significant savings over the life of the loan. Consider Points: Paying for discount points upfront can lower your interest rate. Calculate whether the upfront cost is worth the long-term savings. Stay Informed: Keep an eye on economic news and Federal Reserve announcements. Understanding market trends can help you time your mortgage decisions more effectively. 5. Future Projections and Considerations While it’s challenging to predict exact future movements in mortgage rates, staying informed about potential trends can be beneficial: Economic Recovery: Continued economic recovery and inflation pressures might lead to gradual rate increases. Federal Reserve Actions: Pay attention to the Federal Reserve’s stance on interest rates and monetary policy, as these will significantly influence future mortgage rates. Market Conditions: Real estate market conditions, including housing supply and demand dynamics, will also play a role in future rate trends. Conclusion Understanding the current mortgage rate environment is crucial for making informed homebuying and refinancing decisions. By staying informed about economic factors, comparing different loan options, and implementing effective strategies, you can navigate the mortgage landscape of 2024 with confidence. Remember, the right mortgage can significantly impact your financial well-being, so take the time to research and make the best decision for your situation.

ABOUT A. J. RYAN REALTY

We are the number one stop in South Florida for buying and selling real estate. We’ve been serving the area for more than 100 years, and we do it with pride.

LOCATION

34 Northwest First Avenue

Dania Beach, Florida 33004